How to run your own mortgage franchise

- Published: by MoneyQuest HQ

- |

- Category: Recruitment

Ever wondered how to run your own mortgage franchise? If you are a mortgage broker, chances are you’re well versed in the art of writing loans, liaising with clients, and dealing with lenders. But running your own mortgage broking franchise is a whole different kettle of fish. So how does it work? What should be taken into consideration? What are the benefits? Here are six key things to consider, to help you run your own mortgage franchise.

1. Costs

Purchasing a franchise is a big investment. It is therefore important that you do your due diligence and understand all of the costs involved. Consider whether you have the capital required to pay for things like any upfront fees or franchise fees, an office fit out, equipment, insurance, and signage. There are also ongoing expenses to consider too, such as office supplies, salaries, rent, maintenance, and uniforms. Franchisors often provide franchisees with an accurate overview of the start up costs and future expenses involved in opening a mortgage franchise, and can estimate when you are likely to start turning a profit.

2. Business planning

If you have just taken the leap and become a mortgage franchise owner, congratulations. You now might like to consider creating a strategic business plan that outlines your short-term and long-term business goals. This will help you to determine what it is you are trying to achieve, and by when. Consider breaking your goals into different areas such as financial goals, operational goals, and business development goals, and then identify the key activities that need to be completed in order for these goals to be achieved. Be sure to track your progress and reflect on what worked and what can be done differently in the future.

3. Key services and target market

If you are thinking about running your own mortgage franchise, identifying your business’s areas of expertise and target market is crucial. Will you focus solely on residential lending? Or will your services extend to areas such as commercial lending, asset finance, construction loans and debt consolidation? Are you targeting first home buyers, the self-employed, or seasoned investors? Pinpointing your services and target market will help to inform your marketing strategy. For example, if you are looking to target young professionals buying their first homes, social media might be the best avenue to advertise your services. Or, if you are focusing on assisting families with consolidating their debts, newsletter letterbox drops or a sponsorship arrangement with the local school might be effective.

4. Workplace and staff

Deciding where to work from and who (if anyone) you will employ are also important considerations when running your own mortgage franchise. Working from an office building will generally be more expensive than working from home, however there are benefits to running your business from a commercial space. Consider things like brand awareness, community involvement and the level of professionalism you are hoping to achieve. Staff is also an important consideration. Whether you are looking to employ staff immediately or in the future, there are employment standards, requirements

and laws that needs to be complied with. Educate yourself or seek assistance from your franchisor to learn about your legal obligations as an employer.

5. Contacts and referrers

Building a network of industry contacts and referrers can help your mortgage franchise to grow. One benefit of joining a franchise group is having access to a network of fellow brokers to bounce ideas off and communicate with. Many franchisors facilitate broker to broker communication via social media platforms, virtual meetings, forums, and conferences. Forming connections within your local community can also help to grow your business. Partnering with other local businesses, sponsoring local events, schools, and clubs, and building relationships with key community figures can help with generating referrals and increasing brand awareness.

6. Franchisor support

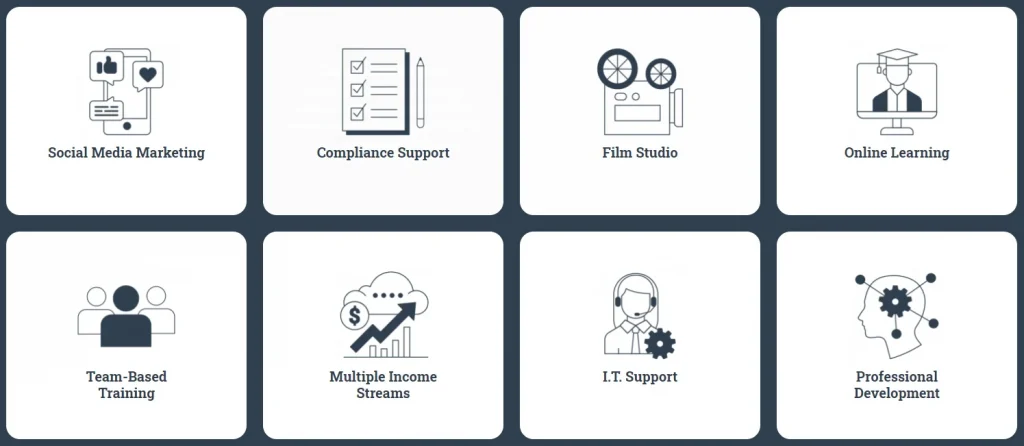

If you are aspiring to run your own mortgage franchise, it is important to understand that you won’t be without support. Mortgage brokerage franchisors typically provide a whole host of support services to their franchisees to help them with setting up and growing their businesses. At MoneyQuest, our franchise owners are provided with compliance education, marketing support, systems training, IT assistance, and personalised business development sessions. They are also given direct access to our experienced and knowledgeable head office team, who work hard to ensure that each MoneyQuest business thrives.

There are several things to consider when it comes to running your own mortgage franchise. It is a big undertaking and there are risks involved. However, becoming a mortgage broking business owner may lead to increased work-life balance, additional learning opportunities, enhanced career satisfaction, and financial rewards. If you would like to learn more about becoming a MoneyQuest franchise owner, visit our website: www.moneyquestfranchise.com.au.

Disclaimer:

This article is written to provide a summary and general overview of the subject matter covered for your information only. Every effort has been made to ensure the information in the article is current, accurate and reliable. This article has been prepared without taking into account your objectives, personal circumstances, financial situation or needs. You should consider whether it is appropriate for your circumstances. You should seek your own independent legal, financial and taxation advice before acting or relying on any of the content contained in the articles and review any relevant Product Disclosure Statement (PDS), Terms and Conditions (T&C) or Financial Services Guide (FSG).

Please consult your financial advisor, solicitor or accountant before acting on information contained in this publication.

Let’s get started!

Want to control your hours, income and success? Open a MoneyQuest franchise!

We are ready to help you control your destiny! Reach out today.